Here are some fresh trends – 2018 from Fruit Logistical Trend Report.

Globalisation and new technologies continue to impact the fundamentals. These are only the most obvious megatrends; many other forces, ranging from the changing demographic make-up of our societies to the impact of climate change, as well as our increasing focus on health and wellbeing, are shaping not just what is consumed, but how and where it is consumed.

Just making sense of these disparate forces presents something of a challenge. However, it is essential that we attempt to make sense of them, if we are to understand the future of the fresh produce supply chain. To this end, we started our analysis with an assessment of the global megatrends affecting business today.

1.Demographic asymmetries

– Growing world population

– Urbanisation & densification

– Rise of Asian &African middle class

– Ageing socieities

– Gender gap decrease

2.Economic globalisation

-Selective deindustrialisation

Changing balance of economic power

-Global mobility

-Usage economy

-Rise of digital disruptors

3.Resource constraints

-Volatility of raw materials

-Green energies

-Ecosystem at risk

-Climate change

-War for talents

4.Innovation acceleration

-Digital & data

-Smart devices& infrastructure

-Life sciences booming

-Industry 4.0

-Autonomous transportation

5.New governance models

-Public debt crisis

-Asymmetric conflicts

-NGOs and citizenship

-Global cooperation

-Knowledge society

6.Evolving consumption

-Health and wellness

-New social networks

-Low cost/premium polarisation

-Anxiety

-Homing

Several of these megatrends will affect how the fruit and vegetable business operates in the years to come. We have selected four trends that demand particular consideration:

Increasing world population

How will changing demographics influence fresh produce consumption? In which parts of the world will the biggest changes occur, and over what time periods?

Digital technologies and data

How much will these be enablers for online fresh produce supply? Are these technologies likely to drive increased transparency along the fresh produce supply chain? Will they, as in other sectors, create new business opportunities?

Autonomous transportation

How significant an impact will increased flexibility and speed have on the fruit and vegetable supply chain? And how soon before the industry experiences notable change?

Health and well-being

Will the recent trend for diets that favour fresh produce continue? Will consumers’ increasing scrutiny of the quality of fresh fruit and vegetables favour certain products, such as organically farmed and low-carbon fresh produce?

Drilling down one level further enables us to see how innovation in each of these areas is likely to shape where and how fresh fruit and vegetables will be sold in the future.

Future trends in fresh fruit and vegetable markets

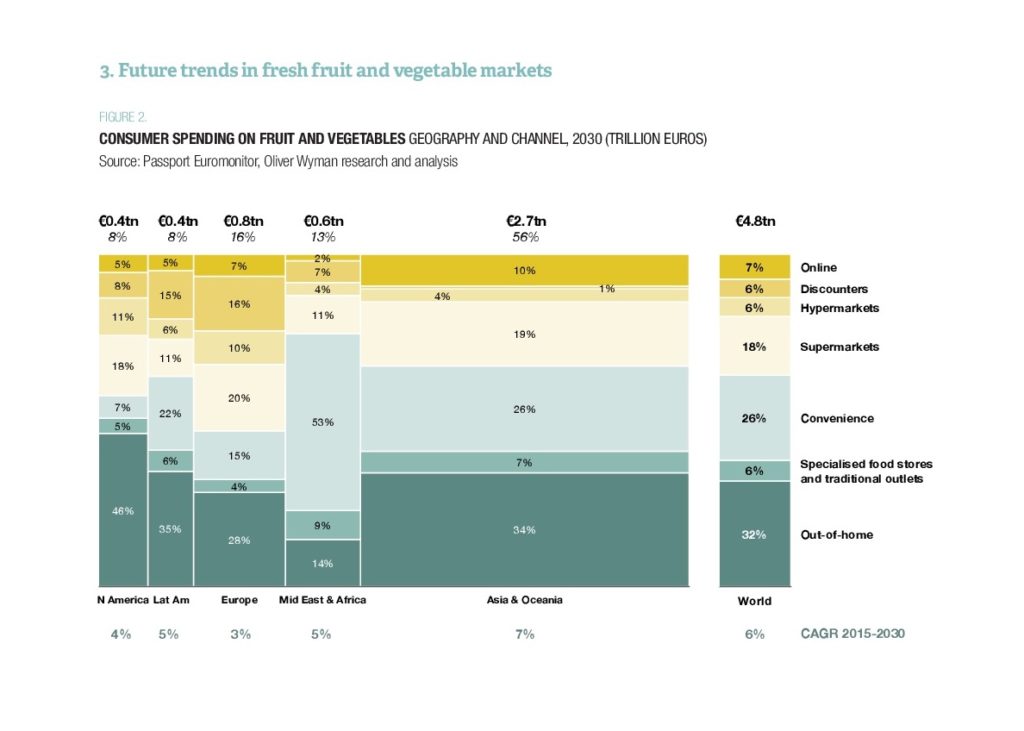

In order to understand where fruit and vegetables are likely to be sold in the future, we modelled fresh produce expenditure along three dimensions: by geography, by consumption occasion (at home versus out-of-home) and by channel (traditional outlets versus online). First, the good news for producers: we expect to see significant growth in fresh fruit and vegetable consumption in all parts of the world. The increase in demand will be driven largely by population expansion in combination with growing expenditure on food – in general, as well as, increasingly, thanks to enhanced nutritional choices that favour fruit and vegetables in particular.

This growth does present the business with challenges. There is likely to be wide variation between regions and income groups in terms of how these demand and consumption patterns evolve over time. While some will develop quickly, others will evolve much more slowly. Understanding these patterns will be key to developing a winning strategy and aligning operations to serve them.

Geographical shifts

The headline news is that the markets of Asia and Oceania will grow substantially, gaining greater significance within the global picture of fresh produce consumption. Whereas the populations of industrialised nations in western Europe and America are growing slowly, if at all, those in Asia, as well as the Middle East and Africa, will continue to grow. In some parts of the world, this growth will be rapid. Combined with notable income increases, this will reposition respective markets in terms of their relative importance. Collectively, the rapidly developing regions

– Middle East, Africa, Asia and Oceania – are poised to grow their share of the fresh produce market from 60 per cent of in 2015 to almost 70 per cent in 2030. There are distinct differences between each one within this

overall picture, however. Owing to its strong per-capita gdp growth, Asia will expect to see rapidly increasing demand for healthier food products among its emerging middle classes. As a number of producers and exporters have seen already in recent years, this will lead to a rebalancing of demand as consumers eat less of the basics, such as rice, and more fresh foods. Some of these developments will be the result of higher demand in regions that are today somewhat remote from the supply chain. This presents challenges for the present setup. For suppliers to seize this opportunity, they will need to be able to serve such regions. Take, for example, Africa’s urbanised areas: we expect significant growth here, but currently more than two-thirds of the population still lack ready access to food supply. Absolute levels of fresh fruit and vegetable consumption will continue to rise in North America and Europe, but by 2030 their relative importance as a percentage share of global consumption will be in decline. In the main,

this will be the result of lower growth rates and less notable changes in nutritional demand.

Shifts between consumption occasions

Over the past couple of decades, there has been dramatic movement towards out-ofhome consumption. This has been a big driver of overall demand and profitability. While we expect this trend to continue, the pace of

change is likely to slow. From the fresh produce industry’s point of view, there is some welcome news to be

found within this overall picture. We expect to see fresh fruit and vegetables play a more prominent role in the out-ofhome market. North America is likely to remain an out-ofhome stronghold: not only does it have the largest market share, but it is also already supported by well-established, highly consolidated restaurant chains, complemented by fully professionalised supply chains.

Youtube та Підписуйтесь!